BlackRock’s Bitcoin ETF just became its most profitable in under 2 years

BlackRock’s iShares Bitcoin Trust (NASDAQ: IBIT) has officially become the firm’s most profitable exchange-traded fund (ETF), less than two years after its debut.

The milestone points to the growing interest in Bitcoin (BTC) on Wall Street, with ETFs serving as a key gateway for institutions to gain exposure to the asset.

Notably, the success of IBIT has helped fuel Bitcoin’s ongoing bull run, which recently culminated in a record high above $123,000. As of press time, Bitcoin was trading at $120,133, up over 1% in the past 24 hours.

Since its launch in early 2024, IBIT has delivered returns of around 300% for investors, with demand surging amid Bitcoin’s rally, according to Bloomberg ETF analyst Eric Balchunas.

IBIT assets surge to $88 billion

In an X post on July 14, Balchunas called the growth “un-freaking-believable,” noting that IBIT’s assets have exploded to $88 billion.

He added that IBIT is now the 20th-largest ETF overall in the United States and the seventh-largest in BlackRock’s entire lineup.

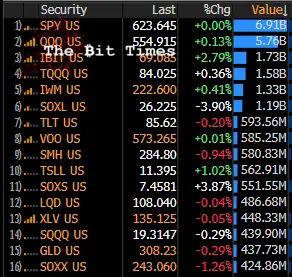

Demand for the ETF is further highlighted by the fact that it was the third most-traded fund in the U.S. on July 14, trailing only the giant S&P 500 ETF (SPY) and the Nasdaq-100 ETF (QQQ).

The Bitcoin rally has been a major catalyst for this momentum. With the world’s largest cryptocurrency setting new record highs, flows into spot Bitcoin ETFs have ballooned.

Balchunas estimates these products have attracted $50 billion in net new money since their launch, with IBIT alone accounting for more than half of those inflows.

Alongside Bitcoin ETFs, Ethereum-focused funds have also seen increased interest, though on a smaller scale.

Featured image via Shutterstock

Comments

Post a Comment