VeChain: AI Predicts VET Price For December 1, 2024

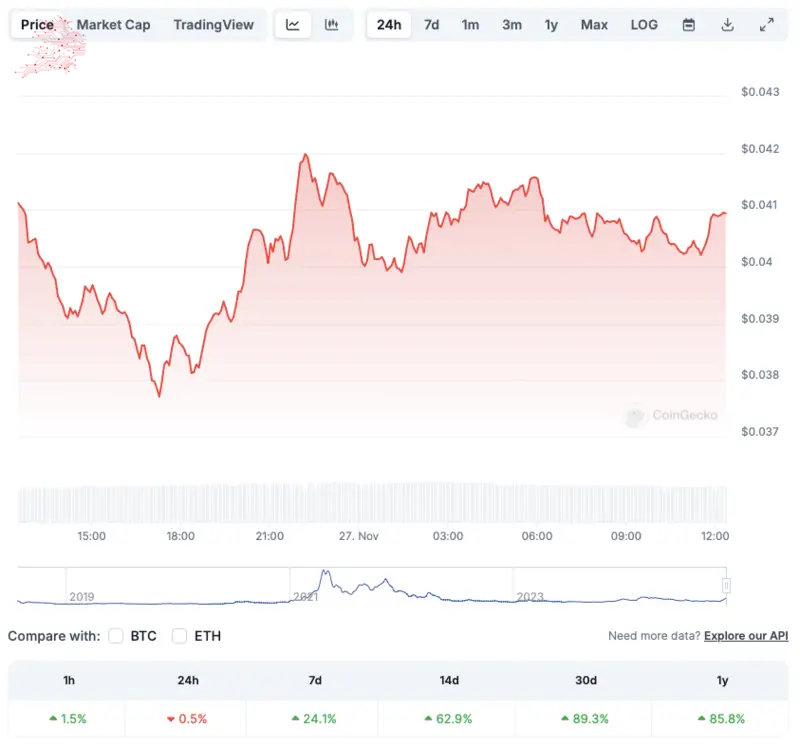

VeChain (VET) has faced a 0.5% correction in the last 24 hours. The dip follows Bitcoin’s (BTC) recent dip to sub-$93,000 levels. Despite the correction, VET has maintained some gains in the other time frames. The asset is up by 24.1% in the weekly charts, 62.9% in the 14-day charts, and 89.3% over the previous month. VET’s price has also risen by 85.8% since late November 2023.

Also Read: Ripple: Will XRP Hit $2 In December 2024?

Why Is The Market Dipping?

The latest market correction is likely due to increased volatility over the last weekend. BTC hit an all-time high of $99,645.39 on Nov. 22, 2024. Investors and market participants may have decided to book profits as the original crypto inched closer to the $100,000 mark.

Also Read: Walmart Stock a Buy at ATH: Can WMT Build on 72% Surge?

VeChain (VET) and other assets follow BTC’s trajectory, leading to a market-wide dip. BTC has recovered the $93,000 mark earlier today. If the asset begins an ascent, we may witness another market surge.

VeChain’s Price For December 1, 2024

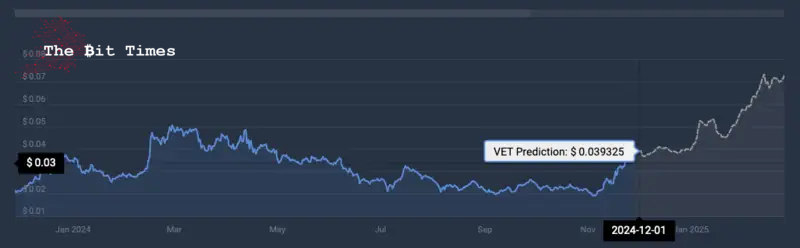

CoinCodex presents a bearish short-term outlook for VET. The platform anticipates the asset’s price to dip to $0.0393 on Dec. 1, 2024. Hitting $0.039 from current price levels will entail a dip of about 2.5%.

Despite a bearish short-term outlook, CoinCodex anticipates VeChain (VET) to pick up the pace by the end of December. The platform anticipates the cryptocurrency to hit $0.073 on Feb. 13, 2024.

Also Read: BRICS: Why Trump Won’t Stop Alliance From Ditching US Dollar

Changelly also anticipates a bearish December for VET. The platform anticipates the asset to trade at a maximum price of $0.025 next month. Sliding to $0.025 from current price levels will entail a dip of about 37.5%.

Comments

Post a Comment