Global Crypto Gaming Market Expected to Grow to $206 Billion by 2025

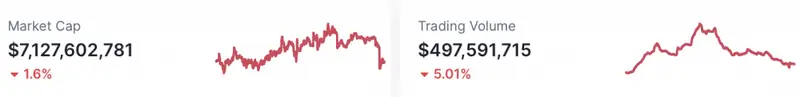

Crypto gaming tokens have enjoyed their fair share of ups and downs over the past few years. Owing to the sluggish market conditions lately, they have not been faring that well. According to data from CoinMarketCap, the aggregate valuation of tokens in this space has dropped by 1.6% to $7.1 billion over the past day. This was accompanied by a 5% dip in trading volume.

Also Read: 74% Americans ‘Stressed’ About Personal Finances: U.S. Dollar to Drop?

Gaming Industry Size

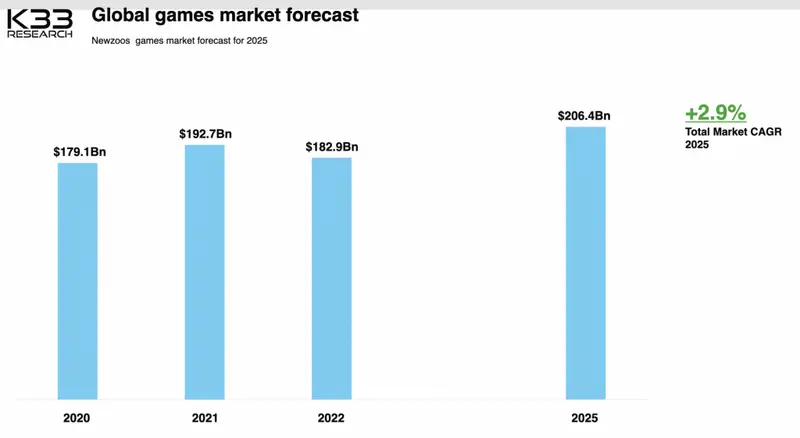

The broader gaming sector has seen significant growth over the years. In fact, it has also outdone the film industry’s collections in the past. A recent report from K33 research highlighted,

“In 2022, the industry saw $183 billion in revenue, which is roughly 7 times more than global movie box office revenue. To put the rate of growth into perspective, the gaming industry was valued at only $8 billion in 2006 – that is a near 23x gain.”

Crypto gaming, in particular, has also seen its share of growth in recent years. However, it has been in the form of “dramatic booms and busts.” In 2021–22, Crabada rose to fame and fetched its users significant ROIs. In fact, it also went on to dominate the Avalanche network and trigger congestion issues.

However, it was soon unveiled that the traffic was not a consequence of the game attracting players. It was the work of an alleged 13-year-old Harvard, MIT graduate at Cynical Hate DAO who botted the game to death.

Also Read: Ethereum Price Analysis: ETH at ‘Make It’ or ‘Break It’ Range

In fact, that notorious user also brought down the price of the asset to zero. Along with the drop in value, the token has also lost most of its volume over the past year.

Crypto, Web3 Gaming Projections

Other top gaming projects like Axis Infinity, The Sandbox, Decentraland, Gala, and Enjin continue to survive. However, they have been impacted by crypto winter and have lost a significant share of their market caps.

K33’s research report highlighted that crypto games have not been fun enough, and as a result, they have been finding it difficult to survive and thrive. The traditional gaming industry is dominated by “high-budget highly-refined AAA game series” like PUBG, The Witcher, and GTA. Such games have the most players and register the most revenue. However play-to-earn crypto games are fragmented across chains, marketplaces, and audiences and have “no cohesive community.”

As a result, projects end up competing with each other for liquidity. More often than not, one gaming project ends up faring well because liquidity flows out from another. In fact, crypto has also not been able to bridge the gap between Web3 and traditional gaming. However, the state of affairs is changing now. The report highlighted,

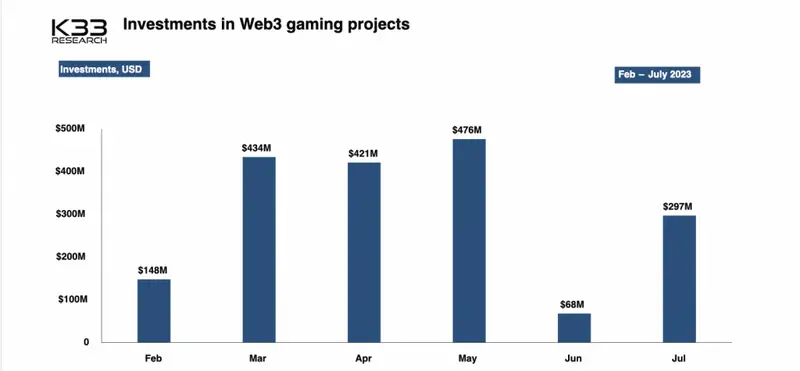

“The Web3 gaming market has recently seen a significant spike in investment, with a massive rebound in July seeing ~$300m invested into the sector. While 37% of that sum went to individual games and metaverse concepts, 63% went to infrastructure projects.“

K33’s DeFi Analyst David Zimmerman, however, remains optimistic. He concluded the report by asserting,

“I am confident that crypto gaming will have another big run. Even if you are an avid gamer and hyper-cynical about crypto having any impact on the industry, you should recognize that we will see another cycle with huge trading opportunities.“

Also Read: Coinbase: 83% of G20 & Top Hubs Have Made Crypto Regulatory Progress

Comments

Post a Comment