Bitcoin: Is A Christmas Miracle Rally Likely?

The death cross is quite an integral part of technical Analysis. Such a crossover occurs when a short-term moving average falls below a major long-term moving average. Conventionally, the death cross brings along with it bearish momentum and suggests a down flip in the price.

As illustrated below, Bitcoin’s 50 DMA is on the verge of falling below the 200 DMA. At press time, there was just a $50 difference between the two on the 4-hour timeframe.

Parallelly, on the weekly timeframe also, Bitcoin’s 50 and 200 EMA’s are on the brink of crossing each other. In fact, a pseudonymous analyst on Twitter highlighted that such a death cross [involving EMAs] has never been seen in the past.

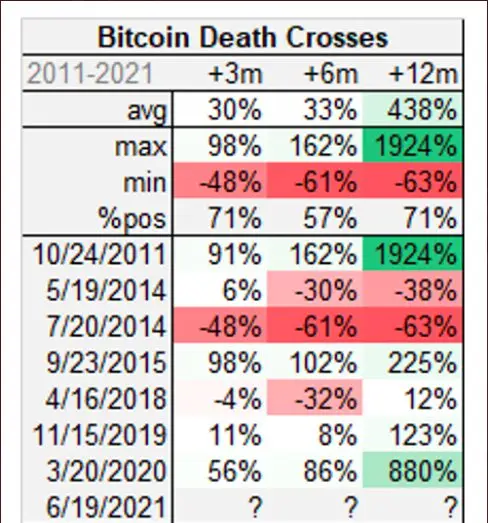

The usual MA death crosses, however, have been registered multiple times by Bitcoin in the past. Most notable crosses have materialized after major bull runs. HODLers have suffered significant cumulative losses in many cases. However, by the end of it, green returns have mostly been noted.

This indicator, however, cannot be 100% relied upon. As chalked out by Jurrien Timmer, Director of Global Macro at Fidelity,

“Death crosses can keep us out of the worst bear markets, but they can also give many false warnings (i.e. smaller corrections that are mostly over by the time the signal hits).“

Is a Christmas Rally For Bitcoin On The Cards?

Keeping the current market conditions in mind and opining on what to expect going forward, Vladimir Gorbunov, Founder, and CEO of crypto firm Choise.com, told Watcher Guru via a textual commentary,

“As of now the price of BTC is around $16,800 slightly rebounding from the low of $16,400. However, another market downturn is likely.”

Leaving aside the technical bearish indication, Gorbunov pointed out that the 50 basis point increase in interest rate by the US, England, and EU Central bank dented the sentiment. More so, because the moves painted a “worsening economic picture,” causing many to sell their assets.

Also Read: Bitcoin: Long-Term Trader RoI Drops To -34%

Gorbunov also highlighted that the Mazars Group and Armanino, two of the most prominent auditors, dropped their services for crypto companies. That has further left many with “doubts about the market’s stability.”

At the moment, Bitcoin is on the verge of stepping into its major resistance zone. In the price bracket between $16.9k and $23k, 6.12 million addresses have bought a whopping 3.13 million BTC. This means that as and when they break even, they’ll be triggered to cash out.

Gorbunov, however, did not rule out the possibility of a holiday-hype-induced rebound. He said,

“A rebound back to the 2-week high of $18,370 is possible in the short term driven by the holiday hype.”

On the macro front, however, it might take time for things to recover. Chalking out what to expect in 2023, the expert told Watcher Guru,

“However the weak macroeconomic picture paired with the ever larger systemic crypto space issues indicates that the bear market is not to be over soon. The overall picture will not improve soon and BTC might hit the bottom at $13,000 support level in 2023.”

Comments

Post a Comment